What’s New

Posted on February 18, 2026

How South Carolina Small Businesses Can Prepare for Funding Before Applying for a Loan

Read MorePosted on January 29, 2026

CLIMB Fund Maintains Top Position as South Carolina’s #1 SBA Microlender

Organization leads the state in both number of SBA microloan loan volume and total dollars deployed

Read MorePosted on December 04, 2025

Mission-Driven Capital: The Future of Entrepreneurship in South Carolina

South Carolina’s small businesses are essential to our communities. With lending standards tightening, mission-driven lenders are providing the flexible financing and support entrepreneurs need.

Read MorePosted on October 23, 2025

CLIMB FUND SECURES FIRST-TIME GRANT FROM WACCAMAW COMMUNITY FOUNDATION TO EXPAND STATEWIDE IMPACT

Funding expands Elevate360 program, providing consulting and technical assistance for entrepreneurs

CLIMB Fund is proud to receive a 2025 Competitive Grant from Waccamaw Community Foundation to support its Elevate360 program, providing small business consulting and technical assistance. The grant, announced during the Foundation’s Granting Day celebration on October 9, will help expand Elevate360’s reach to more entrepreneurs across South Carolina, offering one-on-one guidance, workshops, and resources to help small businesses grow and thrive.

Read MorePosted on May 06, 2025

Navigating Debt & Repayment Strategies with EVERFI

Navigating debt is challenging for many Americans, especially in today’s economic climate. Financial institutions can be a trusted resource in helping their customers understand exactly where they stand financially.

Read MorePosted on March 18, 2025

CLIMB Fund Expands Upstate Reach with New Community Development Loan Officer, Teosha Edmond

As CLIMB Fund continues to expand its impact and footprint across South Carolina, we are thrilled to welcome Teosha Edmond as our new Upstate Community Development Loan Officer.

Read MorePosted on March 05, 2025

CLIMB Fund Celebrates Women’s History Month by Uplifting Women Entrepreneurs

March is Women’s History Month, a time to honor the achievements, resilience, and contributions of women throughout history. At CLIMB Fund, we recognize the crucial role that women entrepreneurs play in driving economic growth, fostering innovation, and strengthening communities.

Read MorePosted on February 12, 2025

Pioneering a Green Future for South Carolina: CLIMB Fund Selected for Prestigious OFN Nascent Climate Lender Pilot Training Program

CLIMB Fund is proud to announce its selection for Opportunity Finance Network’s (OFN) Nascent Climate Lender Pilot Training Program, a six-month initiative designed to accelerate the development and impact of climate-focused lending programs. This highly competitive program attracted over 100 applicants nationwide, and CLIMB Fund is honored to be among the 35 organizations chosen to participate.

Read MorePosted on February 03, 2025

What is Black History Month, and Why Does It Matter to Small Business Owners?

February is a month of reflection, celebration, and education—Black History Month. But what exactly is Black History Month, and why is it so important for small business owners? Let’s take a deeper look at its significance and the role it plays in today’s economy.

Read MorePosted on January 24, 2025

CLIMB Fund's Statement on the Threat to Small Businesses Posed by the Rollback of Basic Civil Rights

The administration’s recent federal directive, dismantling decades-old protections against discrimination in federal hiring, granting, and contracting, marks a profound step backward.

Read MorePosted on January 10, 2025

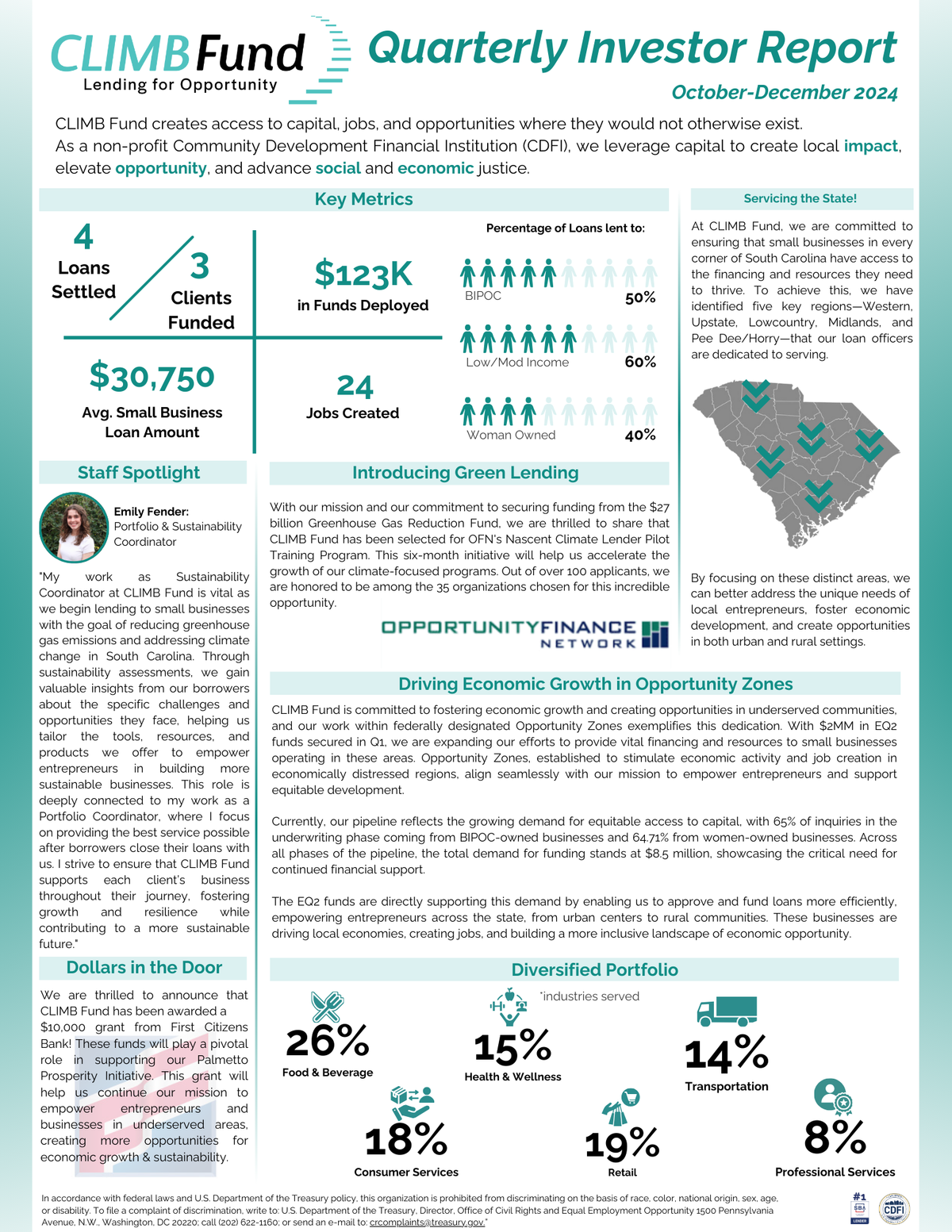

CLIMB Fund Q1 Investor Report: Driving Opportunity, Advancing Sustainability, and Expanding Economic Impact

As we launch into 2025, CLIMB Fund remains steadfast in its mission to drive economic growth and create opportunities for underserved communities across South Carolina.

Read MorePosted on January 06, 2025

Sustainability Meets Opportunity: CLIMB Fund Pioneers Green Lending to Transform South Carolina's Business Landscape

In an era where sustainability is more than a buzzword, small businesses across South Carolina are seeking ways to reduce their environmental impact while enhancing operational efficiency. With the GreenPath SC program, CLIMB Fund is stepping up to meet this need with robust and innovative green lending opportunities, designed to support businesses in their sustainability efforts, driving both economic development and environmental stewardship.

Read MorePosted on October 17, 2024

CLIMB Fund Q4 Investor Report: Analyzing Growth, Optimizing Operations, and Securing Future Investments

As we close out the final quarter of the year, CLIMB Fund remains focused on our mission to foster economic development across South Carolina.

Read MorePosted on October 10, 2024

CLIMB Fund Strengthens Its Team: Bruno Kretzschmar Takes the Helm as Portfolio Manager

In a strategic move to bolster its rapidly expanding operations, CLIMB Fund, South Carolina's premier Community Development Financial Institution, proudly announces the return of Bruno Kretzschmar as its new Portfolio Manager.

Read MorePosted on October 08, 2024

Celebrating Excellence: Keonta’ Ramsey of CLIMB Fund Named 2024 Charleston 40 Under 40 Honoree!

CLIMB Fund is proud to celebrate a remarkable achievement as Keonta’ Ramsey, our Growth Manager who spearheads marketing, communications, and development, has been honored as a 2024 Charleston 40 Under 40 recipient.

Read MorePosted on October 01, 2024

Bank of America Awards CLIMB Fund Grant for Statewide Economic Mobility Initiative

BofA grant will provide for AI technology as part of 2025 Fundraising Enablement Project

Read MorePosted on August 27, 2024

CLIMB Fund Secures Major Investment from First Palmetto Bank to Empower Local Communities and Small Businesses

CLIMB Fund, South Carolina’s top SBA Microlender, is excited to announce a significant investment from First Palmetto Bank, which will bolster the organization's small business lending efforts that support local communities and small businesses.

Read MorePosted on August 26, 2024

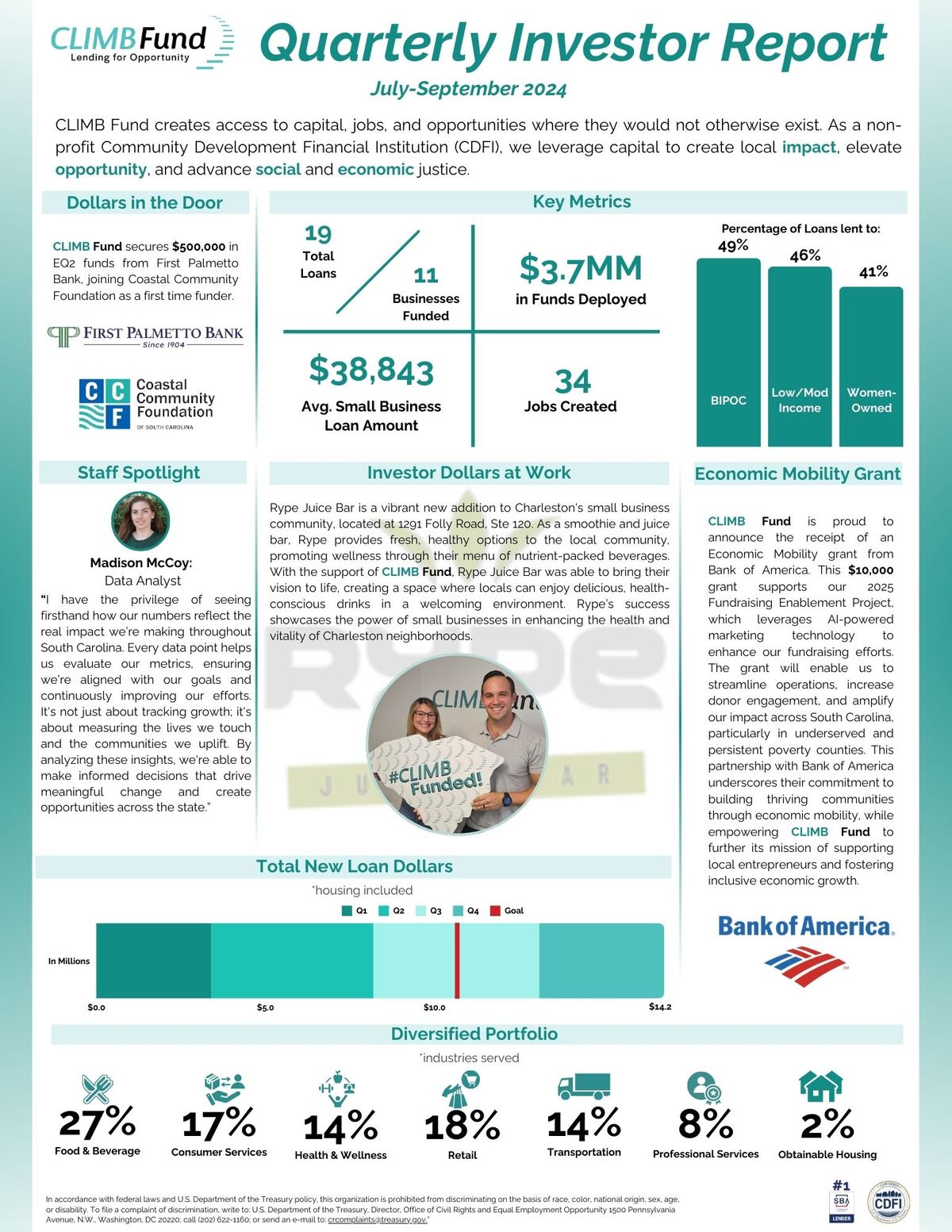

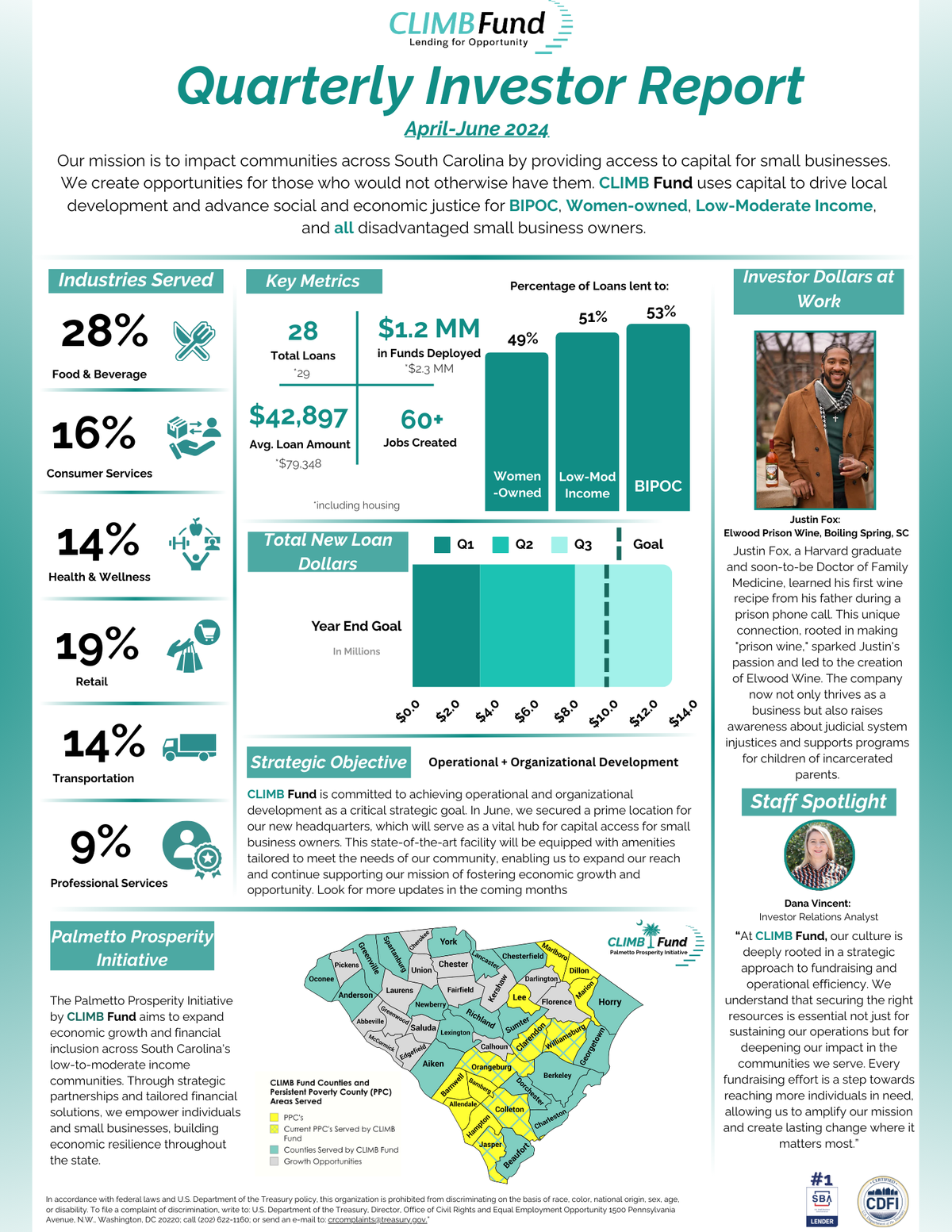

CLIMB Fund’s Q3 Report: Record Growth and Inspiring Success Stories

CLIMB Fund, South Carolina’s top Community Development Financial Institution (CDFI), has released its Quarterly Investor Report for April through June 2024, showcasing significant achievements in supporting local businesses and promoting economic growth.

Read MorePosted on June 11, 2024

Borrower Spotlight: Meet A&A Seafood Shack

Watch owner Dr. Pringle tell about his journey to opening the business, the challenged and struggles they faces, and how CLIMB Fund assisted along the way!

Read MorePosted on June 11, 2024

Building Bridges: The Impact of CLIMB Fund and CDFIs on Economic Empowerment

Discover the game-changers in small business finance! Learn how CLIMB Fund and CDFIs are revolutionizing access to capital and empowering entrepreneurs.

Read MorePosted on April 08, 2024

Borrower Spotlight: Meet Fisher Recycling

Watch Owner Chris Fisher tell about his journey to opening the business, why small businesses should care about sustainability, their work with glass repurposing for countertops, and how CLIMB Fund assisted along the way!

Read MorePosted on April 04, 2024

South Carolina Microlending Powerhouse Achieves New Heights in Impact Report

CLIMB Fund announced today the release of its 2023 Annual Report, which captures another year of significant impact under the theme "Small Business, Big Impact."

Read MorePosted on March 13, 2024

CLIMB Fund Honored as Top SBA Microloan Provider in South Carolina

CLIMB Fund is proud to announce it has been recognized by the U.S. Small Business Administration (SBA) as both the leading provider of SBA Microloans by volume and the leading provider by total dollars loaned in South Carolina for 2023.

Read MorePosted on March 04, 2024

CLIMB Fund Earns Recertification as a CDFI, Continuing Mission of Economic & Social Justice

CHARLESTON, SC - CLIMB Fund, a 501(c)(3) nonprofit and federally certified Community Development Financial Institution (CDFI), proudly announces its recertification as a CDFI, solidifying its commitment to leveraging capital in support of social and economic justice.

Read MorePosted on February 06, 2024

CLIMB Fund Proudly Announces the Grand Opening of Styles N Smiles in Kingstree, SC

CLIMB Fund, a non-profit Community Development Financial Institution (CDFI) dedicated to creating local impact and advancing economic justice, is pleased to announce the grand opening of Styles N Smiles Hair Salon owned and operated by Felisha Conyers.

Read MorePosted on February 01, 2024

Black Business Development in South Carolina: A Timeline

By Akua Page, CLIMB Fund Business Development Coordinator, Intake Specialist, and Gullah Geechee social entrepreneur

As we celebrate Black History Month, CLIMB Fund acknowledges the extraordinary power and spirit of Black entrepreneurs through an historical exploration of Black business development in South Carolina.

Read MorePosted on December 15, 2023

Borrower Spotlight: Meet Bexley Fish & Raw Bar

Watch Chef and Owner Jeremy Holst tell about his journey to opening the restaurant including overcoming the obstacles of cancer, what he calls his "story of 'No,'" and how CLIMB Fund was able to assist with the restaurant's funding needs.

Read MorePosted on October 23, 2023

Miss out on our Recession-Proofing Your Business Panel Discussion + Q&A?

Don't worry! Watch here to get exclusive tips on the topic from industry experts.

Read MorePosted on September 27, 2023

Borrower Spotlight: Meet Barrier Island Oyster Co.

Press play!

Read MorePosted on July 26, 2023

Welcoming our new Upstate Loan Officer!

Plus, our latest partnership in the region

Read MorePosted on June 13, 2023

CLIMB Fund Celebrates Juneteenth by Investing in Black-Owned Businesses

By Akua Page, CLIMB Fund Business Development Coordinator and Gullah Geechee social entrepreneur

With Juneteenth around the corner, we believe it’s important to remember what the holiday commemorates and how we can celebrate it, particularly within the world of small business.

Read MorePosted on April 18, 2023

CLIMB Fund Announces $2.85 Million Grant from Treasury Department

This week the CLIMB Fund announced a $2.85 million award from the US Department of the Treasury’s Equitable Recovery Program (ERP). The CLIMB Fund is a not-for-profit Community Development Financial Institution (CDFI) that provides access to capital for disadvantaged entrepreneurs across all of South Carolina. The ERP award will allow the organization to deepen its focus and expand resources in the state’s most marginalized communities.

Read MorePosted on March 01, 2023

Borrower Spotlight: Meet BuenaVista Information Systems

Find out how brothers Adrian and Andres Lorduy started their IT company, BuenaVista Information Systems, and how CLIMB Fund was able to help them with their funding needs! Watch here!

Read MorePosted on February 24, 2023

CLIMB Fund Receives $10,000 Donation from First Capital Bank

We are happy to announce a $10,000 donation from First Capital Bank today.

This investment will be added to our pool of funds for lending to disadvantaged small businesses who have been unable to access capital from traditional financial institutions.

CLIMB Fund CEO Cindi Rourk said, “We could not be more grateful to First Capital for their support. Generous donations like these are critical for our ability to provide flexible and affordable capital to disadvantaged small business owners across the state.”

Read MorePosted on February 15, 2023

CLIMB Fund’s 2022 Annual Report is now published!

The theme *All* of South Carolina speaks not only to our first full year of statewide expansion, but also to the growth of our impact in communities that are most in need of the access to capital we provide.

Check out the stories of clients we've served and learn more about how we create jobs, wealth, and opportunities in places where they would not otherwise exist.

Read MorePosted on January 11, 2023

Listen to what our clients are saying about us:

Watch to find out!

Read MorePosted on December 13, 2022

Borrower Spotlight: Meet Saltwater Cycle

Saltwater Cycle owner Cody Cooper had an idea in 2018 to launch a pedal pub in downtown Charleston. However, after running into some roadblocks with logistics, Cody decided to take his idea to the water. Click here to come aboard and learn more about Cody’s business journey!

Read MorePosted on November 02, 2022

Borrower Spotlight: Meet Washes and Wags Pet Grooming

In 2018, Washes and Wags Pet Grooming came to CLIMB Fund with the project of expanding into a large storefront in Summerville. For the next several years the business was very successful. Then, on May 16, 2022, a defective blower was responsible for burning the entire store. As you’ll see in this month’s client spotlight, owner Kristina is resilient and was not going to let this stop her from running her business, and more importantly to her, paying her employees.

Read MorePosted on October 05, 2022

Borrower Spotlight: Meet New Digital Press

Fernando Soto came to CLIMB Fund to accelerate the growth of his media company, New Digital Press, with new equipment to increase his video production capabilities and expand his offerings to include high quality live productions. Fernando’s company includes the news outlets NuestroEstado.com and The People’s Beat. He has been a strong advocate for CLIMB Fund in the community, and we are proud to present his business for Hispanic Heritage Month’s client spotlight.

Read MorePosted on October 01, 2022

Meet New CLIMB Fund Local Small Business Clients!

Summer 2022 Loan Closing Highlights

Read MorePosted on September 21, 2022

CLIMB Fund Announces First Loan Officer for Pee Dee region

We are excited to announce that our team has expanded to include our first Community Development Loan Officer for the Pee Dee region, Kendra Darity!

Read MorePosted on September 07, 2022

Borrower Spotlight: Meet Lumber Jill’s Axe Throwing Lounge

About four years ago, Jill Forbes, a teacher, and her husband, Heath, a geotechnical engineer, came to us to support their small business dream of creating an axe throwing venue. Their vision of community building, encouragement, and support seemed to line up with our mission. But axes? Watch the video to find out how Jill and Heath turned their idea into a success story.

Read MorePosted on June 24, 2022

CLIMB Fund Staff presents to National Credit Building Symposium

See what our Portfolio Manager, Bruno Kretzschmar, has been up to this week in Washington D.C. at the 9th Annual CBA Credit Building Symposium!

Read MorePosted on June 16, 2022

Spring Loan Closing Recap

We've been busy creating equitable access to capital in SC!

Read MorePosted on June 09, 2022

City Paper: CLIMB Fund spotlighted in affordable housing news

We are thrilled to have been part of the financing for the redevelopment of the historic Archer School into 89 units of affordable housing on Downtown Charleston’s Eastside!

The Humanities Foundation purchased the building in 2020 from the Charleston School District with the hopes of developing it into affordable housing. The project is expected to be completed in early 2024 and the CLIMB Fund was able to assist with financing thanks to its revolving loan fund partnership with the City of Charleston.

Read MorePosted on June 01, 2022

CLIMB Fund Announces First Hire in Midlands

We are excited to announce our first Midlands based employee! Darrell Booker is an experienced economic development and banking professional with more than a decade of experience. He is joining us as a Community Development Loan Officer and is a critical part of our plan to improve access to capital for small business all across South Carolina. Welcome Darrell!

Read MorePosted on May 20, 2022

CLIMB Fund Expands Lending Partnership with City of Goose Creek

The CLIMB Fund and the City of Goose Creek are proud to announce a $500,000 loan fund to support small businesses in the City of Goose Creek!

Read MorePosted on May 11, 2022

CLIMB Fund Honored as South Carolina’s Leading SBA Microlender

The CLIMB Fund was recognized by the U.S. Small Business Administration (SBA) last week as South Carolina’s leading Microlender in fiscal year 2021!

Read MorePosted on March 18, 2022

CLIMB Fund Named as a “Spoke” in the SBA Navigator Program for South Carolina

CHARLESTON, SC – CLIMB Fund, a non-profit Community Development Finance Institution (CDFI) that has been doing community development lending in the Lowcountry since 1979 is pleased to announce that it will serve as one of the 8 participating “Spoke” organizations in South Carolina for the U.S. Small Business Administration's (SBA) Community Navigator Pilot Program (CNPP).

Read MorePosted on March 10, 2022

CLIMB Fund Awarded $100,000 Technology Grant

We are excited to announce that the CLIMB Fund has been awarded a $100,000 grant from the Opportunity Finance Network (OFN) CDFI Tech Grant Program supported by Google.org.

Find out what the plans for our project are here.

Read MorePosted on February 08, 2022

CLIMB Fund releases 2021 Annual Report

CLIMB Fund’s 2021 Annual Report is ready to view! The theme ‘New Heights’ highlights the ways CLIMB Fund grew and helped the community grow during 2021. Starting with the new name, CLIMB Fund, we reaffirmed our identity as mission driven lenders driving economic growth. In the report, learn how we reached New Heights with clients served, statewide expansion, innovative loan products, and new industries.

Read MorePosted on February 07, 2022

The Front Porch Coffee and Creamery is now open!

CLIMB Fund client, The Front Porch, recently opened a brick and mortar location at The Bend in Mt. Pleasant serving coffee, light café food, and Charleston Pops. The Front Porch is owned by the same husband and wife duo that brought us Charleston Pops, a veteran-owned, award-winning food truck and dessert catering company. The Front Porch combines the best elements of Charleston Pops food truck with a warm and welcoming gathering space. Stop by for coffee and breakfast or for a sweet treat later in the day!

Read MorePosted on February 01, 2022

Orange Spot Coffee named #1 essential coffee shop in Charleston

Congratulations to Orange Spot Coffeehouse who recently landed the top spot in Eater Carolinas “13 Essential Coffee Shops in Charleston.” Located near Park Circle in North Charleston, this local coffee shop is known for it’s cozy atmosphere and cha yen, a traditional Thai iced tea. CLIMB Fund is proud of Orange Spot’s success! Check out the full article below.

Read MorePosted on January 25, 2022

Post and Courier features Barrier Island Oyster Co.

Check out this article from the Post and Courier featuring CLIMB Fund client Barrier Island Oyster Co.. Barrier Island Oysters uses a restorative growing method that provides the highest quality oyster while helping to offset the negative impacts climate change has on the Charleston peninsula. Read more about their work below!

Read MorePosted on January 13, 2022

Borrower Spotlight: Meet Land Green

Land Green is a family owned company started in 2020 by Dinavey Isaza and Cutberto Martinez. Land Green offers both landscaping and cleaning services in the greater Charleston region. When Dinavey and Cutberto started Land Green, they needed a loan to purchase machinery necessary to grow their landscaping capabilities, but they experienced challenges finding funding. With help from the CLIMB Fund, Land Green cleaned up their credit and secured a loan.

Read MorePosted on January 11, 2022

Winter Loan Closing Announcements!

The CLIMB Fund is excited to share some of the latest Community Development Small Business Loans we've closed this winter! Click the link to read how CLIMB Fund helped businesses like Ellis Family Wellness and many others!

Read MorePosted on November 12, 2021

Salute to Service: CLIMB Fund Celebrates Veteran’s Day

CLIMB Fund celebrated Veteran’s Day by attending the Beaufort Chamber of Commerce “Salute to Service” event. This event showed appreciation for Veterans through a parade and community festival featuring food trucks and remarks from community leaders.

As a mission driven lender, CLIMB Fund seeks to support those denied access to capital by for-profit banks, especially the Veteran Community! Over 8% of our loans support veteran owned businesses, and we hope to support more veteran owned businesses across South Carolina. Thank you, Veterans!

Read MorePosted on October 13, 2021

CLIMB Fund CEO Participates in Reinventing Our Communities Cohort Program

CLIMB Fund is happy to be a member of the ‘Reinventing Our Communities’ Cohort Program. This program aims to address structural racism and systemic barriers to economic opportunities in the Charleston Community. CLIMB Fund’s CEO, Cindi Rourk, joins with community leaders from the Costal Community Foundation, the City of Charleston, the South Carolina Association for Community Economic Development, Increasing HOPE, and the College of Charleston. The cohort completed six sessions of racial equity training to better understand how to support minority owned businesses. Going forward, the cohort will participate in technical assistance workshops focusing on building an equitable, sustainable local economy.

Read MorePosted on October 11, 2021

Borrower Spotlight: Meet Blades Professional Barbering

Charlton Manigault has been in the barbering business for almost 20 years now. He opened his business, Blades Professional Barbering, on Meeting Street in Downtown Charleston where he spent the first 17 years running his business. Due to rapid development downtown, Blades was forced to move from the original location to North Charleston. Learn how CLIMB Fund was able to Blades open a new location.

Read MorePosted on October 04, 2021

CLIMB Fund reaches milestone of $10,000,000 lent in SBA funds

In September, CLIMB Fund celebrated lending $10,000,000 in SBA Microloan funds since our founding. Each of these loans is $50,000 or under. We are thrilled to reach this milestone and are excited to reach the next $10,000,000.

Read MorePosted on September 29, 2021

CLIMB Fund featured as recipient of Wells Fargo’s Open for Business Program

CLIMB Fund is honored to receive a $750,000 grant as part of Wells Fargo’s Open For Business program. The Open For Business Program is focused on helping diverse business owners recover from the pandemic. These funds enable CLIMB Fund to continue making small business loans and promoting economic opportunity for those who traditionally would not have access to capital.

Read MorePosted on September 27, 2021

CLIMB Fund announces September Loan Closings!

Learn about 5 Community Development loans we closed this month!

Jaymes McCloud started J.H.W. Enterprises in 2018 as the sole employee and grew the business from managing 40 units in the first year to now managing 489 units, but COVID-19 significantly disrupted the business's cash flow. J.H.W. avoided laying off employees, but only managed to maintain current staff at low pay. With this loan package, JH.W. will be able to retain current employees by offering meaningful raises and hire an additional 8 employees to keep up with returning demand.

Read More