FAQs

Our lending guidelines are more flexible than traditional banks because our purpose is community impact, not profit. While we review all aspects of a loan request in our decision-making process, we are able to take more risks in support of our mission.

CLIMB Fund creates jobs, wealth, and opportunities in places where they would not otherwise exist, in communities that are most in need of the access to capital we provide. We especially focus our efforts on supporting BIPOC-owned, woman-owned, and veteran-owned small businesses, as well as businesses located in rural areas.

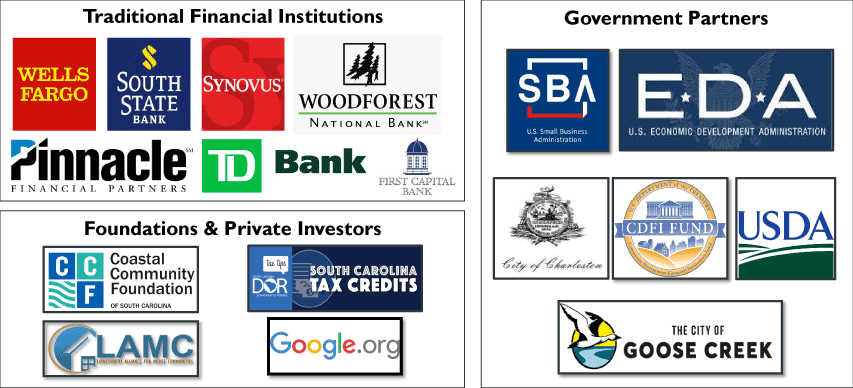

We receive generous investments from partners who make our lending possible including financial institutions like banks, government partners like the city and federal agencies, and from foundations and private investors.

CLIMB Fund has experience lending to small businesses from many industries including retail, health & wellness, food and beverage, trucking & transportation, and consumer services.

CLIMB Fund makes loans to small businesses and entrepreneurs who have been unable to secure traditional financing. Loan amounts range from $5,000 to $500,000. The average loan amount is less than $100,000.

We also offer our clients access to our network of consultants who can provide support with the essentials of running a successful business and even industry-specific topics!

Community Development Financial Institutions (CDFIs) have the goal of expanding economic opportunity in low-income communities by providing access to financial products and services for local residents and businesses.

The CDFI Fund plays an important role in generating economic growth and opportunity in some of our nation's most distressed communities. By offering tailored resources and innovative programs that invest federal dollars alongside private sector capital, the CDFI Fund serves mission-driven financial institutions like CLIMB Fund to support economically disadvantaged communities. Because CLIMB Fund is a CDFI, we are able to participate in CDFI Fund programs that inject new sources of capital into communities that lack access to financing.

No, we are an independent non-profit organization. CLIMB Fund receives local and federal funds for lending, but we make lending decisions independently.

100% of our clients have struggled to secure funding for their projects through traditional sources or have only secured partial funding. In either case, CLIMB Fund can work with your banker to discuss your situation and from there, we can assist you with the funding needs of your business.

Yes! Over 80% of our clients come to us at the start-up phase.

Credit issues are not a hard stop for us. Here at CLIMB Fund, we like to help people that banks and other traditional lenders can't. We tend to look more at the individual and the aspiration. If you're honest with us about potential credit issues, we can typically find ways to work through them together.

Our resource partners are available to assist you with creating your business plan. Check out our Business Resource Center for more information.